How new approaches to customer segmentation affect the bill

30 September 2021

|

Yoram Timmer

Segmentation is the process of grouping by identifiable characteristics. It's an approach that's deeply embedded in the way communications service providers (CSPs) organize their products, price plans, supporting infrastructure, customer support and even their bills. But, with the advent of personalization strategies, is customer segmentation now obsolete or evolving? And how does segmentation affect telecoms bills? Yoram Timmer investigates.

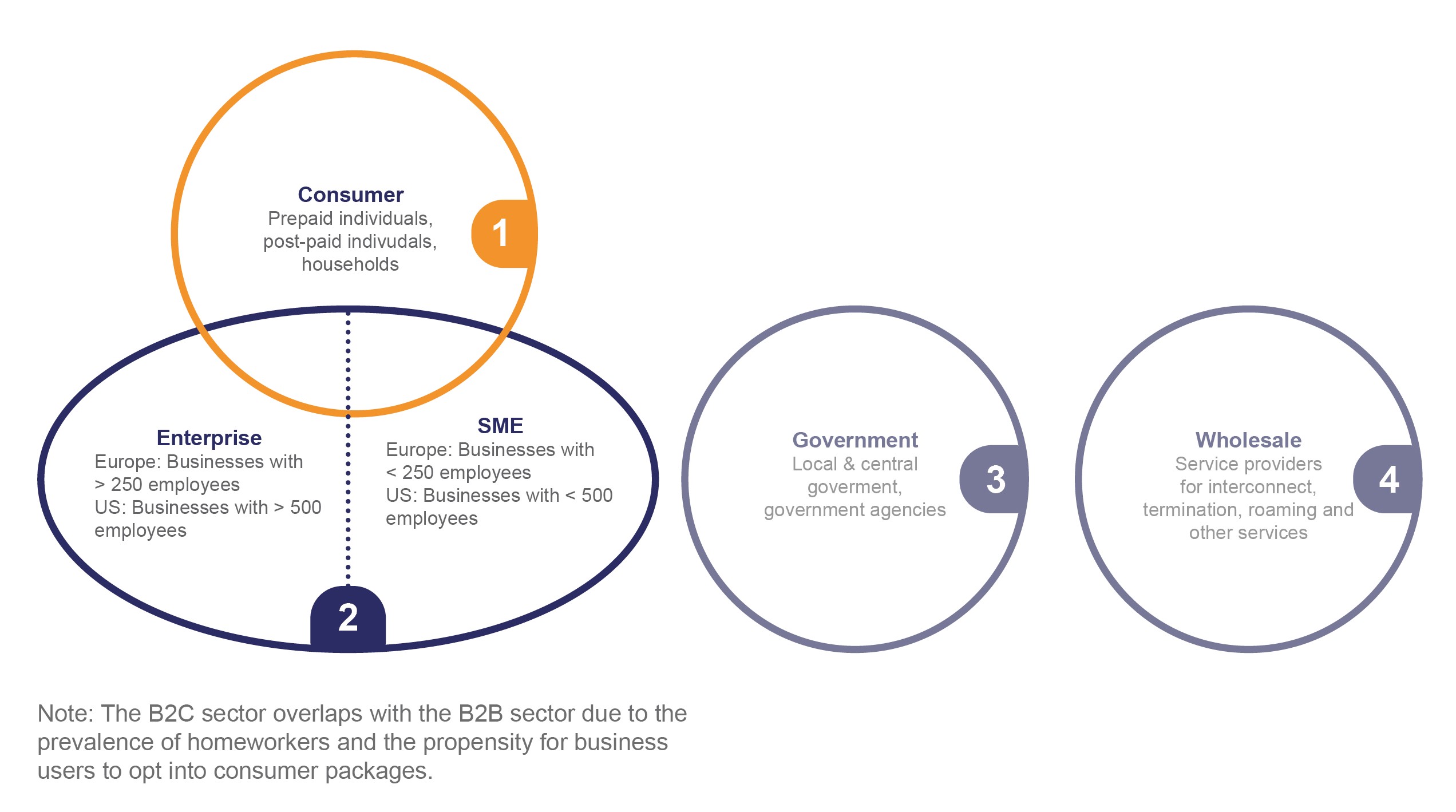

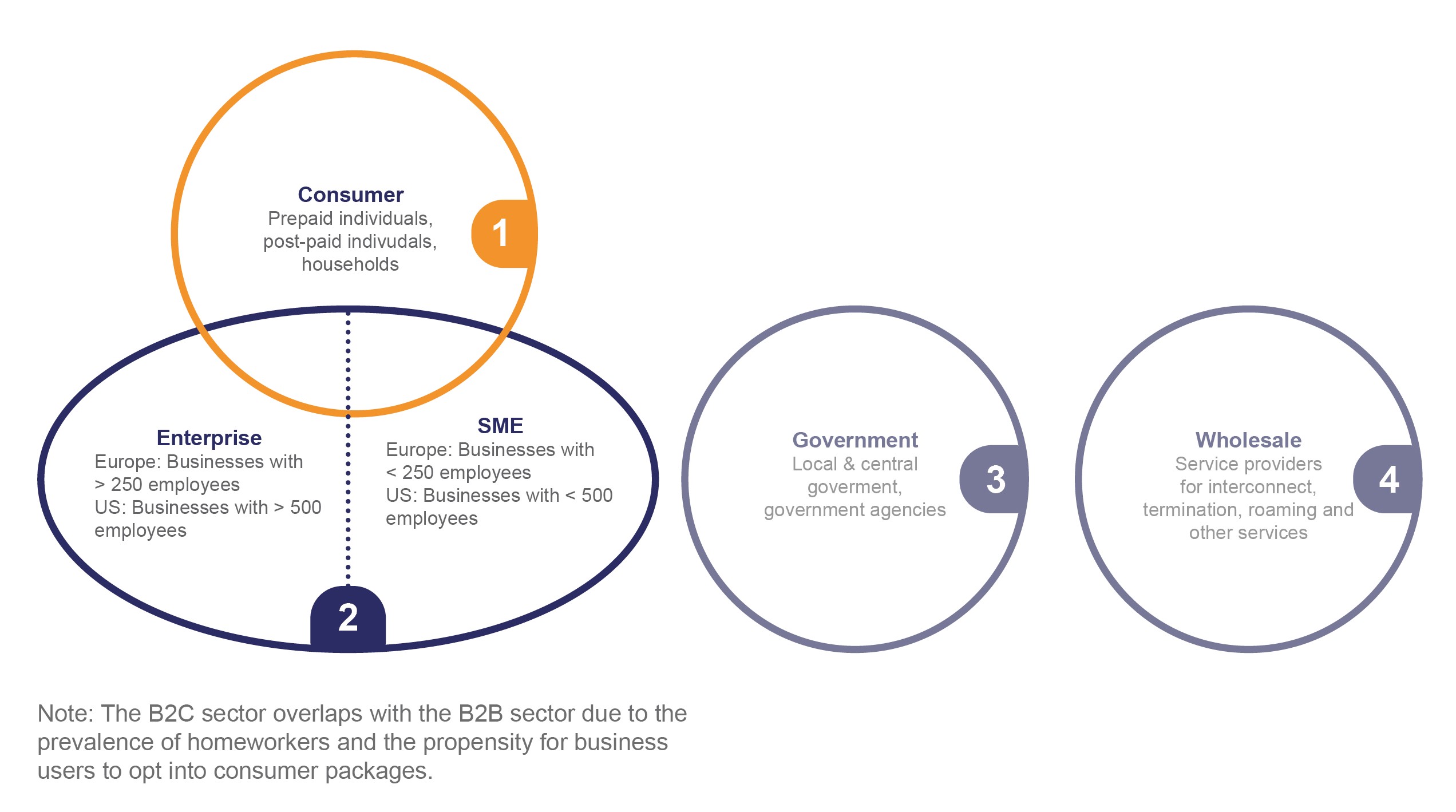

In telecoms there are five main customer segments, which can be viewed as B2C plus four B2B markets. While some CSPs are specialized into a single market segment; others address multiple, but not necessarily all, segments.

This traditional segmentation is achieved by dividing the market according to the number of subscribers per account, customer spending, product complexity and payment methods. However, while it’s better than an entirely generic approach, it still has limitations.

Traditional segmentation is too broad to be actionable

Traditional customer segmentations are both too broad and highly restrictive. The assumptions within these broad sectors are reinforced by siloed and inflexible business support systems (BSS), which also act as barriers to more precise or flexible methods of meeting customer needs. For example, some services will only be offered to enterprise customers and not to SMEs or consumers, even if those customers need them.

The effects of digitalization have exposed key weaknesses in traditional segmentations. For example, automation means some businesses have relatively few employees but sophisticated and substantial ICT needs – undermining the idea that ICT spend is related to number of employees.

Traditional segmentation can be misleading

Not only are traditional segments imprecise but they can also be misleading. CSPs seeking to target SMEs quickly discover that many of their targets are 'hidden' within their B2C customer base. These customers have chosen 'consumer packages', because they're easier to buy and cheaper. However, they may have unmet B2B needs such as the ability to split costs between home and business use, or a requirement for B2B products and applications. The assumption that all customers in the consumer segment only have consumer needs, means some are targeted with inappropriate B2C offers while they are not being targeted with business services they do want.

This issue has become even more pronounced since the increase in homeworking due to COVID-19, which has seen even more business users utilizing household broadband services.

Does segmentation have a future?

Ultimately, the limitation of traditional segmentations is that they result in inaccurate aggregations and make false assumptions about the customer's real needs. But with data-driven and self-personalization becoming a reality, does that mean we no longer need segmentation?

It's tempting to view personalization as replacing segmentation. After all, segmentation is about grouping customers together and personalization is about treating them as individuals. In fact, CSPs need to utilize both strategies in conjunction with one another. While the size of segments will become smaller and better defined (micro-segmentation), there still has to be a minimum-sized market (a segment) in order to make a product or price plan viable and profitable.

In contrast, personalization is a technique that enables CSPs or their customers to tailor the experience. Personalization gives customers the choice to opt into the products, services and features that have been defined – choosing the ones that appeal to them, rather than having their choices limited by assumptions made by the CSP. With personalization, customer preference and behavioral data is utilized to improve the targeting of products and offers, helping CSPs avoid the pitfall of inaccurate aggregations and false assumptions.

What this means for billing

Billing features should be available to customers who need them and segmentation should not stand in the way. For example, rather than second-guessing whether or not an enterprise customer wants a summary PDF bill or a detailed bill, why not offer the customer the choice? Similarly, instead of deciding consumers do not need online access to their bills for longer than 12 months, CSPs could provide free access for 12 months followed by the option to either download bills or maintain online access for a small charge – meeting the need of SME customers hidden in the 'consumer' segment which need continued access to bills for taxation and auditing purposes. Doing this even provides an easy method of ‘discovering’ hidden SME customers within a CSP’s B2C customer base.

Other ways in which bills and billing data can help CSPs become more successful include:

Bills are a critical asset for CSPs moving towards a micro-segmentation approach that is more personalized and more contextual. Billing data can be utilized to develop new segments on an ongoing basis and the real estate of the bills themselves can be used to target customers likely to be interested in a new offer. But the real power of the bill is in providing an alternative to traditional campaign-based approaches to marketing. CSPs can utilize them to upsell and cross-sell dynamically, matching contextual behavior to segmented offers that can then be promoted to customers via the billing portal.

At Calvi, we turn the bill into an asset. To do this, we believe that every part of the billing journey counts! To find out more about segmentation and learn more about our vision, don't hesitate to contact us and discover more about how effective segmentation can be utilized in the large enterprise, SME or consumer sectors.