How to optimize the billing process to improve cashflow

9 December 2021

|

Philipp Reischauer

Operating working capital (OWC) is one of the main elements on every company’s balance sheet that is heavily scrutinized by financial analysts. Making just a few tweaks to the way you bill can significantly improve this key financial metric. Billing expert Philipp Reischauer explains how.

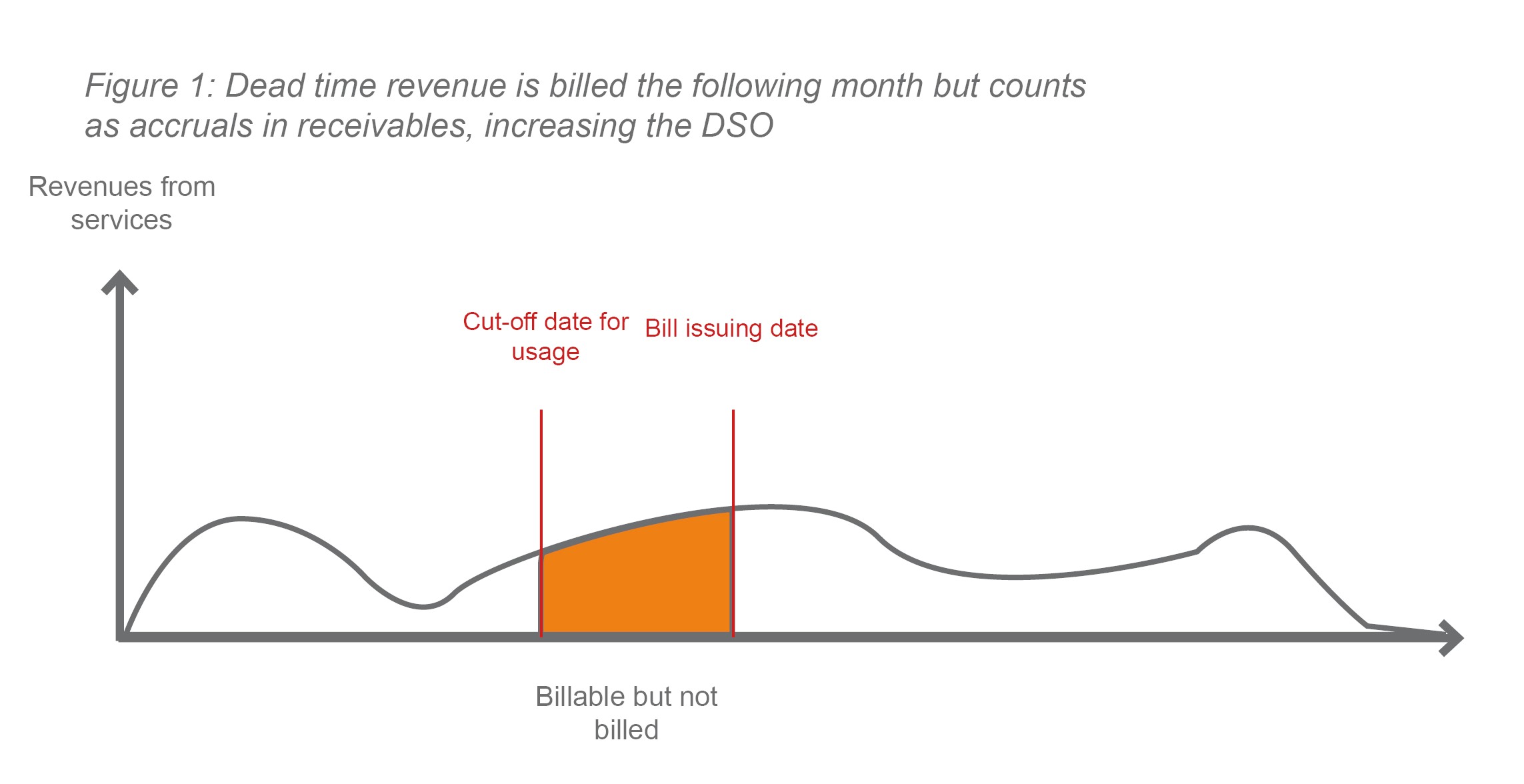

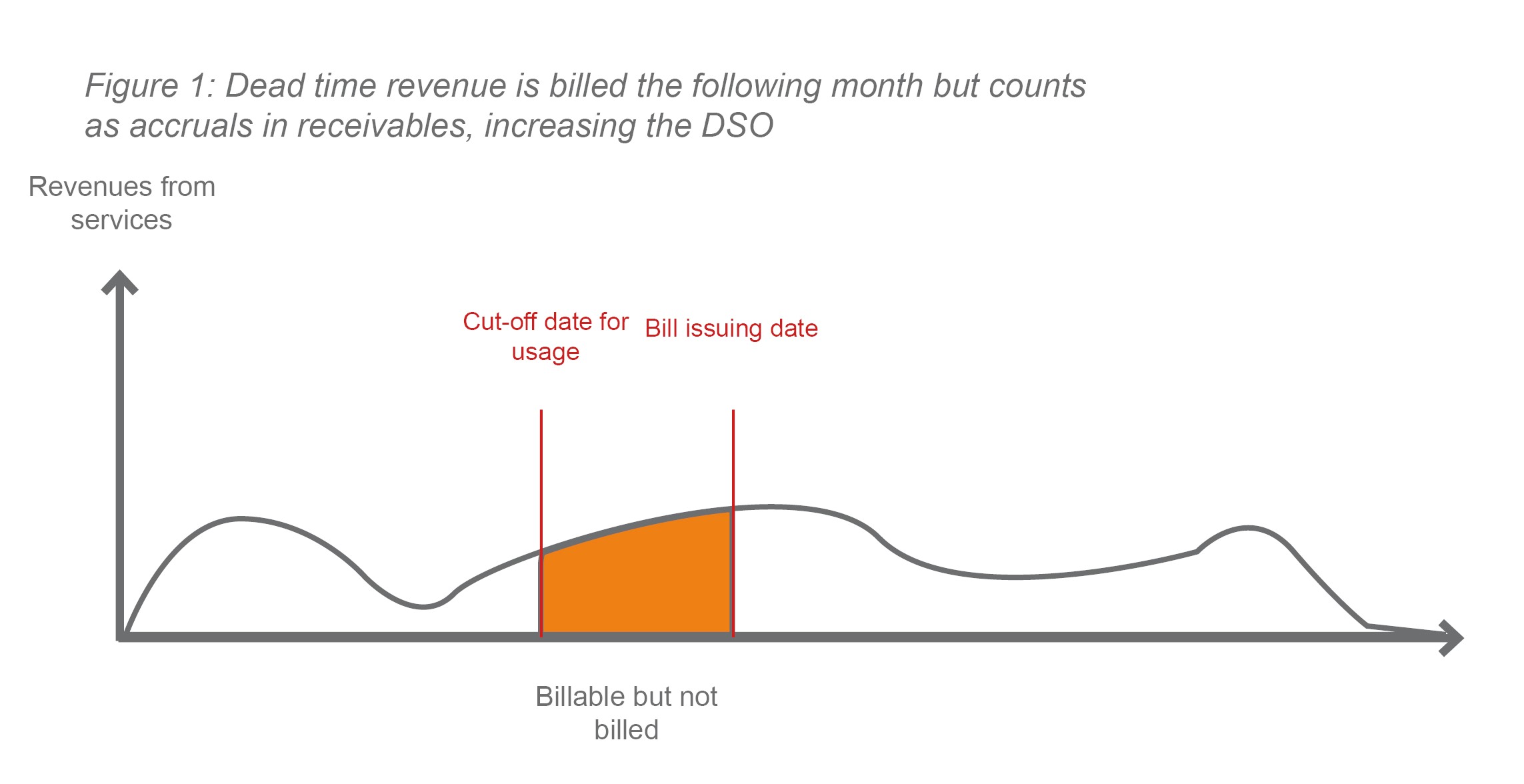

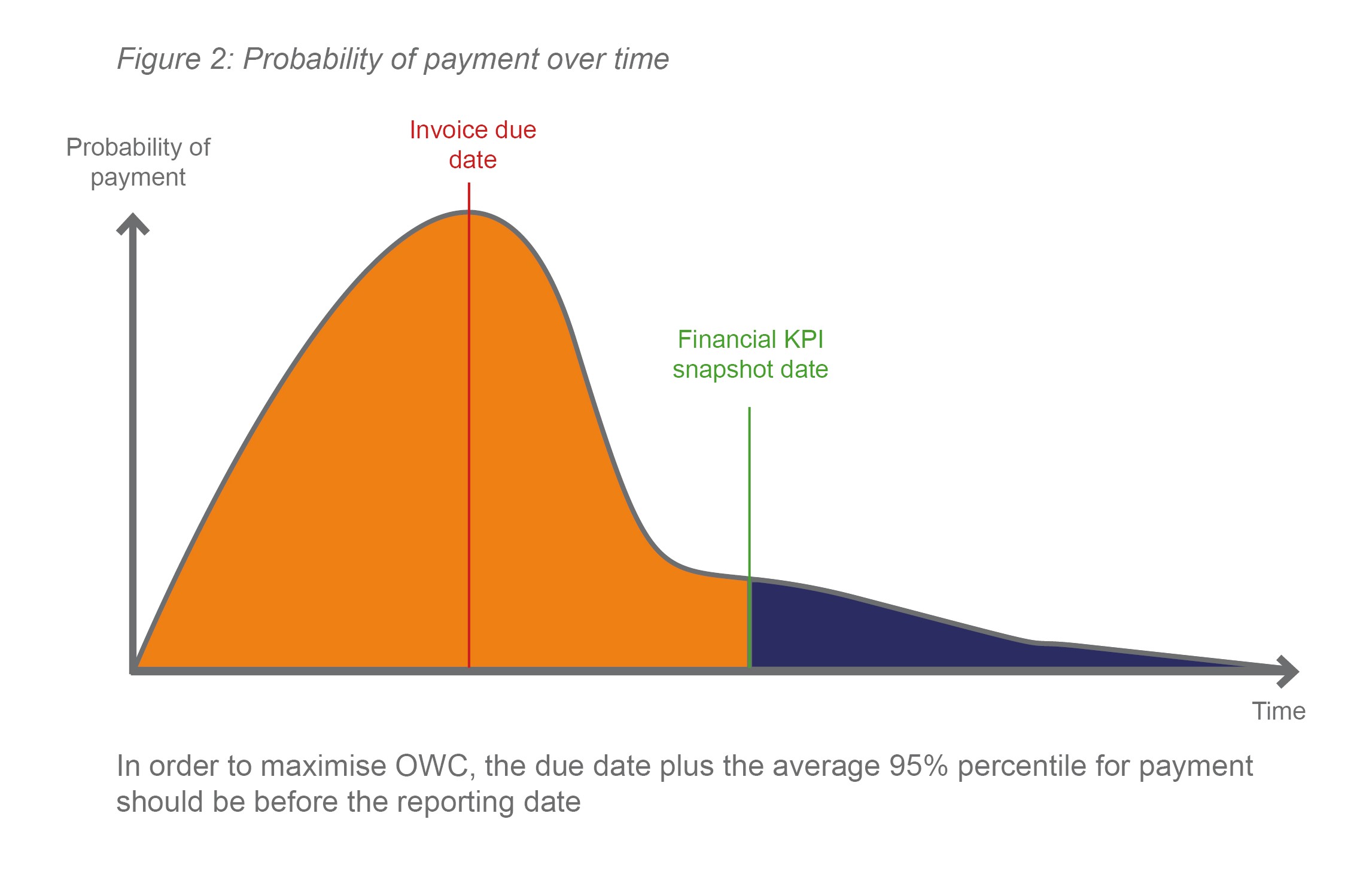

One of the biggest contributors to the operating working capital (OWC) calculation in the post-pay, subscription-based world of telecoms are receivables, and receivables are themselves heavily impacted by the timing of steps taken during the billing process – steps that substantially affect the amount of receivables at the time of reporting. For large CSPs this can translate into a difference of millions of euros in receivables at the time of reporting.

Billing is a carefully designed sequence of smaller tasks and actions held together by a set of business rules that define if, how and when certain steps are executed. While much attention is paid to the ‘if’ and ‘how’ of the billing process, sometimes the ‘when’ doesn’t receive as much attention as it should. Although there have been big changes that affect telecoms bills, these changes haven’t necessarily been reflected in billing cycles.

Billing cycles haven’t changed with the times

Historically, the timing of billing processes was all about trying to process billions of CDRs, then grouping them into customer-relevant offers such as peak and off-peak tariffs and displaying these on a bill. In the past, the vast majority of the bill comprised the itemized usage of voice, SMS and MMS services and, latterly, the amount of data being used.

But, in recent years many things have changed that dramatically affect the bill:

-

Bundled usage has increased – most voice, text and data used today is included within a bundled package, so the only additional charges that makes it to the bill are roaming fees and one-time charges for on-demand services such as video and music streaming, ticket sales, or bolt-on data packages when you run out of gigabytes towards the end of the month. The revenue share of these services has dropped though, and with it something else has changed: the volume of billing-relevant CDRs.

-

The rise of e-invoicing and digital billing - another big change for billing is the rise of the non-paper invoice. In many countries, more than 75% of customers receive e-invoices rather than paper bills, which has an impact on delivery times and due dates. The move to digital billing, which provides dynamic balances, will impact the billing cycle even more.

-

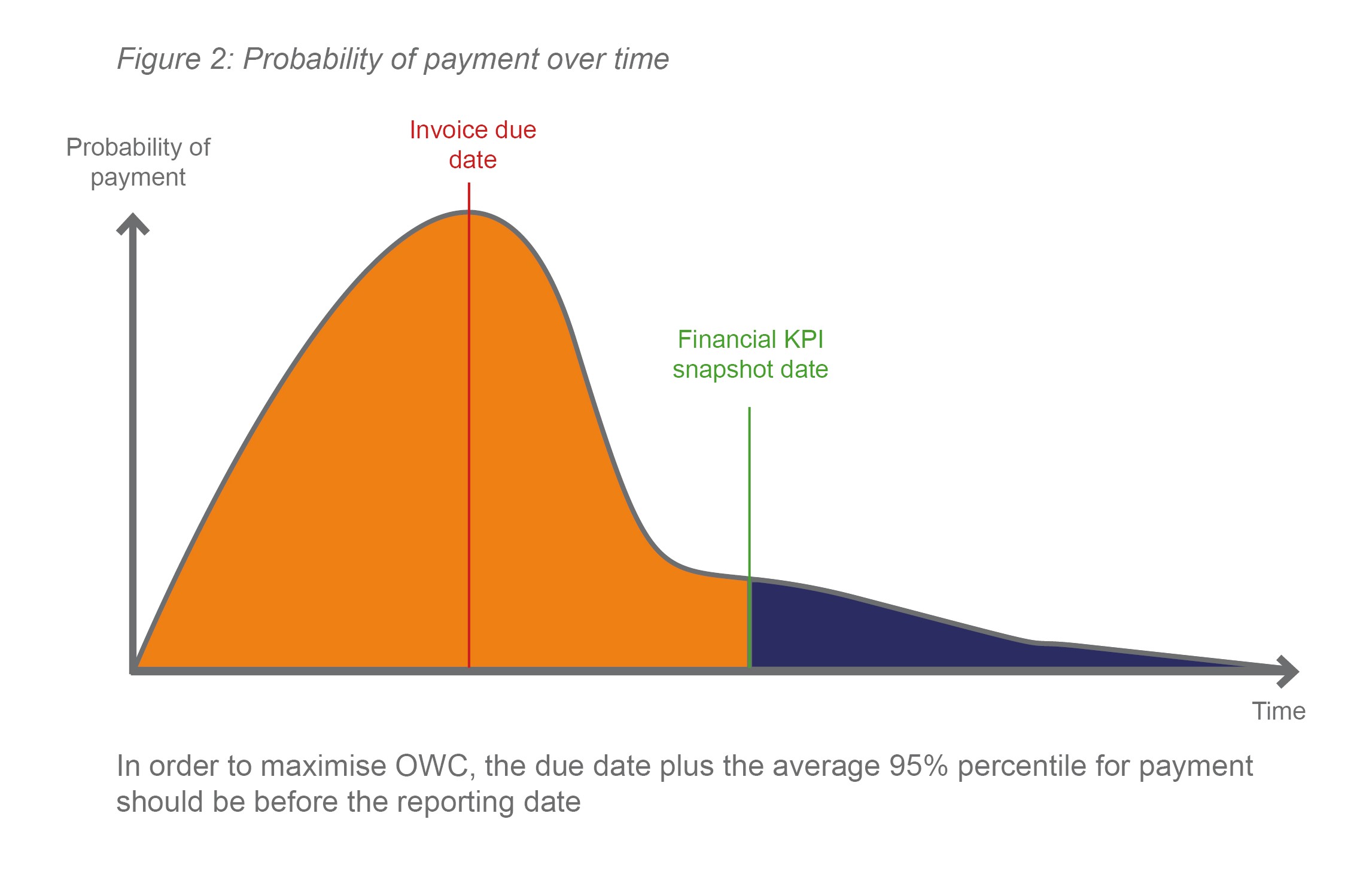

Banks have accelerated the payment process - only a few years ago payments took several days to complete, and information about the transaction was only available once the transaction was completed. Today, transactions are faster and information is available minutes after the payment is executed, meaning that CSPs have to wait less time to receive payments and have more visibility into payments that are about to be credited to their account.

Despite these changes, billing cycles haven’t changed very much: every bill run looks the same, dead times between process steps aren’t optimized, and due dates are the same for all customers of a bill run (regardless of the delivery method). This is partly due to a reluctance to interfere with a process that may not be optimal but which works; but there are simple ways to improve the process.

How to optimize the billing process to improve cashflow

In order to optimize the billing process and improve cashflow, CSPs should:

- produce a timetable with all the billing process steps, their dates and their interdependencies as they are today

- challenge every dependency and wait time. Given the changes cited above, could these wait times be reduced? Are dependencies still the same? Can you split processes according to delivery channels, for example, or count back from the reporting date to the last possible bill date?

- do a risk assessment – which customer groups are most prone to paying late and should be put in early bill cycles to increase the probability of payment?

Much has changed in billing and payment that affects the cycle time for bills, but the (legacy) process may not have been re-examined to reflect these changes. Re-examining the process can pay dividends by optimizing cashflow into the business and positively impacting OWC. Small tweaks to the billing process can have huge impacts on financial performance.

Calvi has decades of cumulative experience on the impact of bill processes on cashflow. Why not reach out to our bill consulting team to discover how you could tweak your bill process to optimize your cashflow?

Contact